In the face of a changing climate, the financial sector is increasingly reliant on precise data and projections to assess investment risks and identify opportunities. Climate data, the new key for finance decision-making, highlights the necessity of having reliable information to accelerate the transition to a climate-resilient global economy. The pressure on financial institutions to contribute to climate adaptation and mitigation has grown, particularly with expectations for a post-pandemic green recovery. Achieving climate goals, such as keeping global warming below 1.5 °C and achieving net-zero emissions by 2050, requires significant investments—between $5 and $7 trillion annually, according to the UN. Notably, climate risk has become synonymous with investment risk, urging financial institutions to understand the impact of climate change on current and future assets.

The financial sector is now focused on two primary types of financial climate risks: transitional and physical. Climate data, the new key for finance decision-making, is integral to evaluating these risks as transitional risks arise from societal and business adjustments to a low-carbon economy, while physical risks result from the consequences of future climate conditions. Evaluating these risks demands engagement with complex climate information, an aspect that has been challenging for the financial sector, but initiatives like the Task Force on Climate-related Financial Disclosures (TCFD) are working to address this gap.

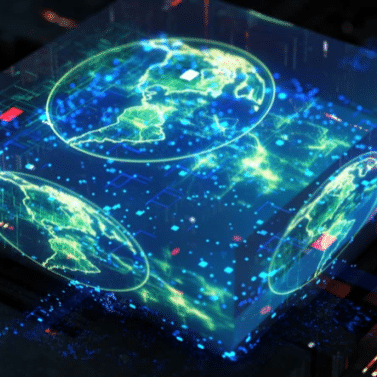

To facilitate this transition, the Climate Data Factory and the Copernicus Climate Change Service (C3S) are collaborating on a pilot project. The project aims to provide financial actors with a dataset of climate hazards, helping them assess physical climate risks in line with TCFD recommendations. Addressing the challenge of accessing data, climate data, the new key for finance decision-making, the project seeks to offer global, comparable information to aid in decision-making across regions.

While progress is evident, managing financial climate risks does not necessarily equate to reducing environmental impact. Organizations like the UN Environment Finance Initiative stress the importance of setting environmental targets for entire portfolios, pushing beyond TCFD recommendations. Despite positive developments, there is still a need for mandatory climate-related financial disclosures and environmental impact disclosures to accelerate the financial sector’s alignment with climate goals. Climate data, the new key for finance decision-making, is essential in this context.

Read the story on Euronews

Check our high-resolution projections of indicators and hazard.